Comprehensive Guide to Liability Insurance for Property Owners

Discover everything you need to know about liability insurance for property owners with our comprehensive guide. Learn the benefits, coverage options, and essential tips to protect your property and manage risks effectively.

Owning property involves numerous responsibilities and potential risks. Liability insurance for property owners is a crucial component of protecting your investment from unexpected events that could lead to significant financial loss. Whether you’re a homeowner, landlord, or commercial property owner, understanding the types of coverage available, typical costs, and how this insurance helps protect your investment is essential.

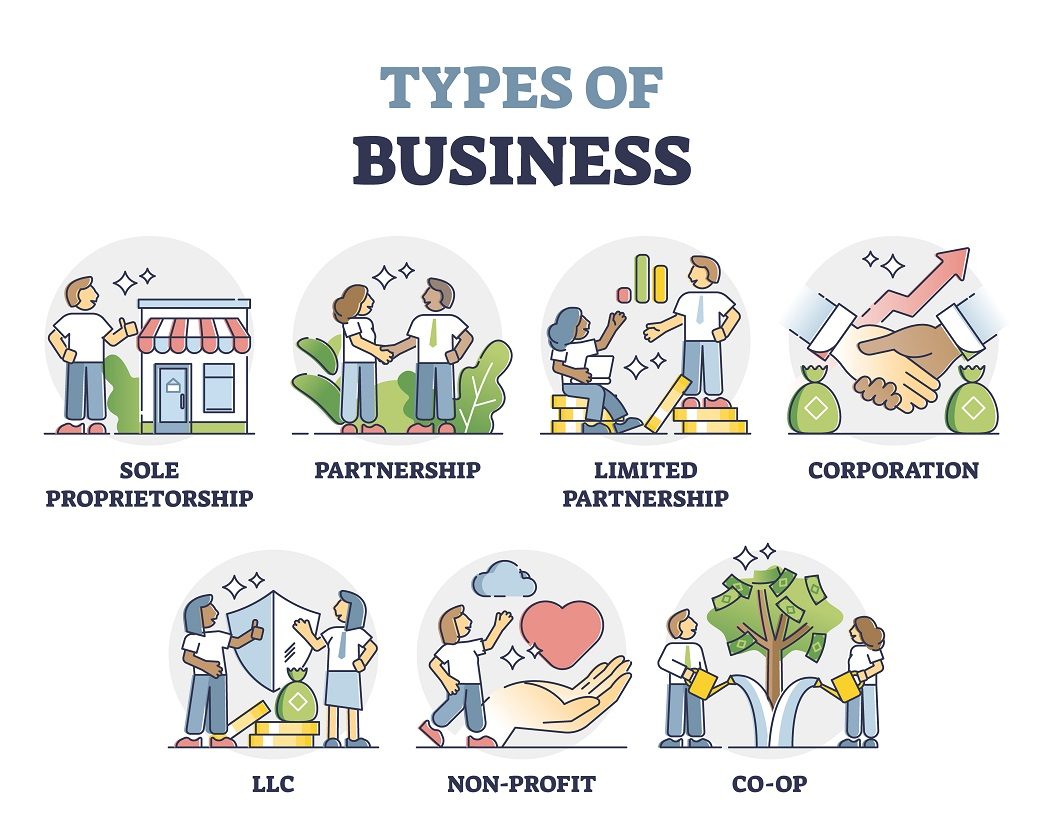

Types of Liability Insurance Coverage

Liability insurance for property owners generally covers several aspects, ensuring comprehensive protection against various risks. Here’s a breakdown of the most common types:

-

General Liability Insurance: This type of insurance protects property owners from claims of bodily injury or property damage that occur on their property. For example, if a visitor slips and falls in your home or rental property, this insurance covers legal costs and any settlements.

-

Property Insurance for Landlords: Landlords often require specialized coverage to protect against liabilities specific to rental properties. This includes coverage for tenant injuries and damages to the property caused by tenants.

-

Insurance for Commercial Buildings: For those owning commercial properties, this insurance covers liabilities arising from business operations on the premises, such as accidents involving customers or employees.

-

Insurance for Historic Homes: Owners of historic properties need specialized liability coverage to address the unique risks associated with maintaining and restoring older buildings.

-

Umbrella Insurance for Homeowners: This provides an additional layer of liability protection above the limits of standard home insurance policies. It’s particularly useful for high-net-worth individuals or those with significant assets to protect.

-

Insurance for Investment Properties: Investors who own multiple properties may need policies that cover various types of liabilities, including tenant-related issues and property damage.

Typical Costs of Liability Insurance

The cost of liability insurance can vary based on several factors, including the type of property, location, and the amount of coverage required. Here’s a general idea of what to expect:

-

Homeowners Insurance Quotes: For a standard homeowners policy, expect to pay an average annual premium ranging from $500 to $1,500. This typically includes liability coverage up to $300,000. For higher coverage limits, premiums will increase accordingly.

-

Property Insurance for Landlords: Landlord insurance often costs between $1,000 and $2,500 annually, depending on the number of units and property location. This includes liability coverage tailored to rental properties.

-

Commercial Property Insurance: Costs for commercial properties can vary widely based on the type of business and the risk involved. On average, businesses might pay between $500 and $3,000 annually for basic liability coverage.

-

Umbrella Insurance: Adding umbrella insurance to your existing policies can cost between $150 and $300 per year for an additional $1 million in coverage.

-

High-Value Home Insurance: If you own a high-value home, premiums can be significantly higher, often exceeding $2,000 annually, depending on the value of the property and the coverage limits.

How Liability Insurance Protects Property Investments

Liability insurance plays a vital role in safeguarding your property investment by providing financial protection against various risks:

-

Legal Protection: If someone sues you for injuries or damages sustained on your property, liability insurance covers legal fees, court costs, and settlements, which can be substantial.

-

Property Damage: In cases where you’re found liable for damages to a neighboring property, liability insurance helps cover repair costs and legal expenses.

-

Tenant-Related Issues: For landlords, this insurance provides coverage for accidents or injuries that occur in rental properties, protecting against potential lawsuits from tenants.

-

Natural Disasters: While liability insurance doesn’t typically cover natural disasters, it can be bundled with additional coverages like natural disaster insurance to offer comprehensive protection.

-

Peace of Mind: Knowing you have insurance coverage in place helps reduce stress and allows you to manage your property with confidence, knowing you’re protected against unforeseen events.

Factors Affecting Liability Insurance Costs

Several factors can influence the cost of liability insurance, including:

-

Property Location: Cities like Omaha, Sacramento, Rochester, Albuquerque, and Richmond may have varying insurance costs due to regional risk factors such as crime rates, weather conditions, and local regulations.

-

Property Value: The value of your property plays a significant role in determining your insurance premium. Higher-value properties generally require more coverage, leading to higher costs.

-

Type of Property: Residential properties, commercial buildings, and historic homes each have different risk profiles, affecting the cost of liability insurance.

-

Coverage Limits: Higher coverage limits increase premiums, but they provide more comprehensive protection against potential claims.

-

Insurance History: Your claims history and previous insurance coverage can impact your premium. A clean record often results in lower costs.

Choosing the Right Liability Insurance

When selecting liability insurance, consider the following steps:

-

Home Insurance Comparison: Compare quotes from different providers to find the best rates and coverage options for your needs. Use property insurance quotes to evaluate different policies and find the best fit for your situation.

-

Best Property Insurance Companies: Research and choose reputable insurance companies known for their excellent customer service and reliable claims handling.

-

Home Insurance Discounts: Look for potential discounts on your insurance policy, such as those for bundling multiple policies or installing security systems.

-

Home Insurance Claims Process: Understand the claims process for your policy to ensure you’re prepared in the event of an incident. Review home insurance policy reviews to gauge the experiences of other policyholders.

-

Insurance for Home-Based Businesses: If you run a business from home, ensure your policy covers any related liabilities.

Top Insurance Companies Offering Liability Insurance for Property Owners: A Comprehensive Comparison

Liability insurance is crucial for property owners, whether you’re renting out a single-family home, managing a commercial building, or simply protecting your own residence. It helps cover legal fees and damages if someone is injured on your property. In this guide, we'll explore the top insurance companies offering liability insurance for property owners, comparing their policies, premiums, and customer reviews. We’ll also provide tips on obtaining property insurance quotes to help you make an informed decision.

Top Insurance Companies Offering Liability Insurance for Property Owners

1. State Farm

State Farm is one of the largest insurance providers in the United States and offers comprehensive liability insurance for property owners. They provide various policy options tailored to different needs, including high-value home insurance and coverage for vacation homes.

Policies and Coverage

- General Liability Insurance: Covers accidents and injuries on your property.

- Umbrella Insurance: Offers additional liability coverage beyond standard policy limits.

- Homeowners Insurance Quotes: Available for both owner-occupied and rental properties.

Premiums

State Farm’s premiums are competitive, especially when bundled with other policies like auto insurance. Their rates are generally in line with the industry average but can vary based on location and risk factors.

Customer Reviews

State Farm is known for its robust customer service and extensive network of agents. Reviews often highlight their efficient claims process and responsive support. However, some customers report higher premiums compared to competitors.

2. Allstate

Allstate is another major player in the insurance market, offering a range of liability insurance options for property owners. They are known for their customizable policies and discounts.

Policies and Coverage

- Property Insurance for Landlords: Designed for rental properties, covering liability and property damage.

- Flood Insurance Coverage: Optional coverage for flood damage.

- Home Insurance Comparison: Allows for easy comparison of different policy options.

Premiums

Allstate’s premiums are competitive, with options for discounts if you bundle multiple policies. Their rates are often lower than some of their larger competitors, making them an attractive choice for budget-conscious property owners.

Customer Reviews

Allstate receives positive reviews for its customer service and innovative digital tools. However, some users have reported issues with claim resolutions and slower response times.

3. Geico

Geico is renowned for its affordability and ease of obtaining quotes online. They offer liability insurance for property owners through a range of policy options.

Policies and Coverage

- Property Insurance Quotes: Geico provides online quotes for various property insurance needs.

- Renters Insurance Policies: Offers liability coverage for rental properties.

- Cheap Homeowners Insurance: Known for competitive rates.

Premiums

Geico is often noted for its lower premiums, especially for basic coverage. However, their lower costs can sometimes mean less comprehensive coverage compared to more expensive providers.

Customer Reviews

Geico is praised for its straightforward online process and competitive pricing. On the downside, some customers have reported less personalized service and longer wait times for claim resolutions.

4. Progressive

Progressive offers a range of insurance options, including liability insurance for property owners. They are known for their flexibility and customer-centric policies.

Policies and Coverage

- Insurance for Investment Properties: Tailored coverage for those who own multiple properties.

- Home Insurance Comparison: Provides tools for comparing policies.

- Home Warranty vs. Homeowners Insurance: Offers clarity on different types of coverage.

Premiums

Progressive’s premiums are generally competitive, with options for various coverage levels and discounts for bundling policies. They offer good value for those looking for flexible insurance solutions.

Customer Reviews

Progressive is well-regarded for its user-friendly digital tools and competitive rates. Some customers have reported issues with claim handling and the complexity of policy terms.

5. Farmers Insurance

Farmers Insurance provides a broad range of coverage options, including liability insurance for property owners. They are known for their personalized service and comprehensive coverage.

Policies and Coverage

- Insurance for Historic Homes: Specialized coverage for older properties.

- Natural Disaster Insurance: Optional coverage for natural disasters.

- Home Insurance for Seniors: Tailored policies for older homeowners.

Premiums

Farmers Insurance offers competitive rates, with options for customized coverage based on individual needs. Their premiums can be higher than some competitors but often come with more personalized service.

Customer Reviews

Farmers Insurance is praised for its customer service and comprehensive coverage options. However, some reviews indicate that their premiums can be on the higher side, reflecting the personalized service and extensive coverage options provided.

Comparing Policies, Premiums, and Customer Reviews

When comparing liability insurance for property owners, consider the following factors:

1. Coverage Options

Ensure that the insurance policy covers all potential liabilities specific to your property. For instance, if you own a high-value home or an historic home, you’ll need specialized coverage.

2. Premium Costs

Compare homeowners insurance quotes from different providers to find the most competitive rates. Be mindful that the cheapest option may not always offer the best coverage. For cheap homeowners insurance, ensure that the policy provides adequate protection for your property and liability needs.

3. Customer Reviews

Review customer feedback to gauge the reliability and quality of service. Look for patterns in reviews regarding claims handling, customer support, and overall satisfaction. Home insurance policy reviews can provide valuable insights into the experiences of other property owners.

4. Discounts and Bundling

Many insurers offer discounts for bundling policies or having security systems in place. Look for providers that offer home insurance discounts or other ways to reduce your premiums without compromising coverage.

5. Claims Process

Evaluate the insurance company’s claims process. Efficient and fair handling of claims is crucial, especially if you need to file a claim due to an accident or damage. Home insurance claims process reviews can help you understand how well different companies manage claims.

Why Liability Insurance is Crucial for Property Owners

When it comes to managing property, liability insurance is a critical component of your overall risk management strategy. Whether you own a primary residence, a vacation home, or rental properties, having robust liability insurance for property owners can protect you from financial loss due to accidents, legal claims, or property damage. In this article, we’ll explore why liability insurance is essential and how it can prevent significant financial strain.

Understanding Liability Insurance

Liability insurance covers legal costs and damages if you’re held responsible for someone else's injuries or property damage. This type of coverage is particularly important for property owners, as it helps mitigate the financial risks associated with accidents and claims that can occur on your property.

1. Accidents on Your Property

One of the primary reasons liability insurance is crucial is that it protects you from financial loss if someone is injured on your property. Whether it's a slip and fall accident, a dog bite, or any other injury, liability insurance covers:

- Medical Expenses: It pays for the injured party’s medical bills resulting from the accident. This can include hospital stays, surgeries, or rehabilitation.

- Legal Fees: If the injured party decides to sue you, liability insurance helps cover legal costs, including attorney fees and court costs.

- Settlement Costs: If a settlement is reached, liability insurance can help pay for the agreed-upon amount to the injured party.

For example, if you own a vacation home in Sacramento and a guest slips on a wet floor, liability insurance can cover their medical expenses and any legal fees if they decide to file a lawsuit.

2. Legal Claims and Lawsuits

Legal claims and lawsuits can be expensive and time-consuming. Liability insurance provides financial protection in the following scenarios:

- Property Damage: If you or someone on your property accidentally damages a neighbor’s property, liability insurance can cover the repair or replacement costs.

- Personal Injury Claims: If a visitor claims that they were harmed due to negligence on your part, liability insurance can help cover the costs of defending yourself and settling the claim.

For instance, if you’re a landlord in Rochester and a tenant’s guest gets injured due to a maintenance issue, liability insurance can protect you from the financial impact of a potential lawsuit.

3. Property Damage

Liability insurance also extends to property damage caused by you or your property. This coverage is crucial for the following reasons:

- Unintentional Damage: If you accidentally cause damage to another person’s property, such as by a tree from your yard falling onto a neighbor’s car, liability insurance can cover the repair costs.

- Vandalism or Theft: If someone vandalizes or steals from your property, liability insurance can cover the costs of repair or replacement.

For property owners in Albuquerque, having this coverage is especially important if you have rental properties or manage multiple properties, as the risk of property damage increases with the number of units you own.

How Liability Insurance Prevents Financial Loss

Liability insurance helps mitigate the financial impact of various risks associated with property ownership. Here’s how it can prevent financial loss:

1. Protects Your Assets

Without liability insurance, you could be personally responsible for paying out-of-pocket for legal claims or damages. This can significantly impact your personal finances and assets. Liability insurance ensures that your assets, including savings and investments, are protected from potential legal and financial claims.

For example, if you own a historic home in Richmond and a visitor is injured on your property, liability insurance will help cover medical costs and legal fees, preventing you from having to use your personal savings or sell assets to cover these expenses.

2. Provides Peace of Mind

Having liability insurance provides peace of mind knowing that you are protected against unforeseen accidents and legal claims. This can be especially reassuring if you are a property owner with multiple properties or a high-value home. It allows you to focus on managing and enjoying your property without the constant worry of potential legal and financial repercussions.

3. Helps in Financial Planning

Liability insurance helps you manage and plan your finances more effectively. By covering potential legal and medical costs, it allows you to budget and allocate resources without having to account for large, unexpected expenses due to liability claims. This is particularly valuable for property owners in Omaha or Sacramento, where property values and associated risks can be significant.

Types of Liability Insurance for Property Owners

Different types of liability insurance can offer varying levels of protection. Here’s a breakdown of the types you might consider:

1. General Liability Insurance

General liability insurance is a broad coverage that protects against a range of liability risks. It covers injuries and property damage that occur on your property. This is suitable for residential property owners, as well as those managing property insurance for commercial buildings.

2. Umbrella Insurance

Umbrella insurance for homeowners provides additional coverage beyond the limits of your existing liability policies. This can be particularly beneficial if you own high-value properties or multiple properties. Umbrella policies offer extra protection and can cover gaps in your primary insurance.

3. Landlord Insurance

For those who rent out properties, property insurance for landlords includes liability coverage specific to rental scenarios. This type of insurance is tailored to cover risks associated with tenants and their visitors, providing additional protection compared to standard homeowner policies.

4. Specialized Liability Coverage

Depending on your property and its use, you might need specialized coverage. For instance:

- Insurance for mobile homes: Provides liability coverage specific to mobile home risks.

- Home insurance for new construction: Includes liability coverage for new builds, protecting against construction-related risks.

How to Obtain the Best Liability Insurance Rates

Securing the best rates for liability insurance involves several strategies:

1. Compare Quotes

Obtain and compare homeowners insurance quotes from multiple providers to find the best rates. Use online tools for home insurance comparison to evaluate different policies and coverage options.

2. Consider Bundling

Bundling your liability insurance with other types of insurance, such as home or auto insurance, can lead to discounts. Many insurers offer lower rates for bundled policies.

3. Increase Deductibles

Increasing your deductible can lower your premiums. Evaluate your financial situation to choose a deductible that balances affordability with coverage needs.

4. Enhance Property Security

Improving security measures, such as installing alarms or upgrading locks, can reduce risks and potentially lower your insurance premiums.

5. Review and Update Policies

Regularly review your insurance policies to ensure they meet your current needs. Update coverage as necessary, especially if you acquire additional properties or make significant changes to your existing properties.

When selecting liability insurance for your property, it's crucial to make well-informed decisions to ensure comprehensive protection. Whether you're in Omaha, Sacramento, Rochester, Albuquerque, or Richmond, understanding the nuances of property insurance can save you from potential financial pitfalls. This article will guide you through the factors you should consider, focusing on coverage limits, exclusions, and additional endorsements.

Evaluating Coverage Limits

Coverage limits define the maximum amount your insurance will pay for a claim. When evaluating limits, consider the following:

-

Property Value: Ensure your coverage limits are adequate for the value of your property. For high-value home insurance, such as in Sacramento, where property values might be high, your limits should reflect the replacement cost of your home and belongings.

-

Personal Liability: This covers legal costs and settlements if someone is injured on your property. In cities like Albuquerque or Richmond, where outdoor activities might be common, higher liability limits are advisable to protect against potential accidents.

-

Risk Factors: Areas prone to specific risks—like natural disasters in Rochester or Omaha—may require higher limits to cover potential damages from floods or severe weather.

Understanding Exclusions

Exclusions are specific scenarios where your insurance won’t provide coverage. It's essential to understand these to avoid surprises during a claim.

-

Flood Insurance Coverage: Standard homeowners insurance quotes often exclude flood damage. If you live in an area prone to flooding, such as Sacramento or Albuquerque, you might need separate flood insurance coverage.

-

Natural Disasters: Some policies might not cover damages from earthquakes, hurricanes, or tornadoes. For regions like Rochester, where such events can be more common, check whether your policy includes these events or if additional coverage is needed.

-

Maintenance Issues: Cheap homeowners insurance might come with exclusions related to wear and tear or maintenance issues. Ensure that your policy doesn’t exclude significant maintenance issues that could lead to costly repairs.

Additional Endorsements

Endorsements are optional additions to your policy that provide extra coverage. Consider the following endorsements:

-

Umbrella Insurance: An umbrella insurance for homeowners offers additional liability coverage beyond your standard policy limits. This is particularly useful in cities like Richmond, where you might face higher risks or where lawsuits might be more common.

-

Home Warranty vs. Homeowners Insurance: While homeowners insurance covers structural damage and liability, a home warranty provides coverage for home systems and appliances. If you have high-value or aging systems in your Omaha or Sacramento property, a home warranty might be a beneficial addition.

-

Insurance for Home-Based Businesses: If you run a business from your home, check if your policy includes coverage for business-related risks. In Albuquerque, where small businesses are prevalent, this endorsement can be crucial.

-

Insurance for Historic Homes: For historic homes in cities like Rochester or Richmond, you might need specialized endorsements to cover unique repair needs and materials.

-

Insurance for Mobile Homes: If you own a mobile home, look for insurance for mobile homes that can cover unique risks associated with this type of property.

Property Insurance Quotes and Comparisons

To find the best coverage, it's wise to obtain property insurance quotes from multiple providers. Home insurance comparison tools can help you evaluate different policies and find the best home insurance rates. Look for insurance for investment properties if you’re renting out your property, and consider insurance for rental properties to cover tenant-related risks.

Final Thoughts

Selecting the right liability insurance involves a thorough review of your needs and potential risks. Be sure to:

- Compare quotes from best property insurance companies to ensure you're getting a good deal.

- Check for home insurance discounts that could lower your premiums without sacrificing coverage.

- Review your home insurance claims process to understand how claims are handled and what documentation you’ll need.

Current Trends in Liability Insurance for Property Owners: A Comprehensive Overview

In the dynamic world of property insurance, staying abreast of trends and changes is crucial for property owners. Liability insurance, in particular, is experiencing shifts influenced by evolving risks, regulatory updates, and changes in policy offerings. This article delves into the latest trends and developments in liability insurance for property owners, with a focus on various aspects including homeowners insurance quotes, property insurance for landlords, and more.

Recent Changes in Policy Offerings

Liability insurance for property owners has evolved to address new challenges and risks. Property owners in cities like Omaha, Sacramento, Rochester, Albuquerque, and Richmond are witnessing changes in their policy offerings, reflecting a broader trend towards comprehensive coverage.

-

Enhanced Coverage for Emerging Risks: Traditional liability insurance is expanding to cover emerging risks such as cyber threats and environmental damage. Insurance for high-risk areas and natural disaster insurance are becoming more prevalent, addressing concerns such as wildfires in California or floods in the Midwest.

-

Increased Focus on Umbrella Insurance: Many property owners are opting for umbrella insurance for homeowners to supplement their primary liability coverage. This additional layer of protection is beneficial in high-stakes scenarios, providing coverage beyond the limits of standard policies.

-

Specialized Coverage Options: There's a growing trend toward specialized insurance products, such as insurance for historic homes and insurance for mobile homes. These policies cater to the unique needs of different property types, ensuring adequate protection.

Regulatory Developments

Recent regulatory changes are reshaping the landscape of liability insurance. Here’s a look at some key developments:

-

Stricter Building Codes and Safety Standards: Many states are enforcing stricter building codes and safety standards, impacting home insurance for new construction and insurance for rental properties. Property owners must ensure compliance to avoid potential coverage issues.

-

Updated Flood Insurance Requirements: Flood insurance regulations have been updated to reflect changing climate patterns. Flood insurance coverage is now more critical, with revised guidelines affecting property owners in flood-prone areas. The home insurance claims process has also been adjusted to streamline claims related to flooding.

-

Regulations for Short-Term Rentals: With the rise of platforms like Airbnb, many jurisdictions have introduced specific regulations for insurance for vacation homes and insurance for investment properties. Property owners need to understand these regulations to ensure compliance and adequate coverage.

Emerging Risks

The landscape of risks is continuously evolving, prompting changes in liability insurance policies. Key emerging risks include:

-

Climate Change and Environmental Hazards: Increasing instances of extreme weather events, such as hurricanes and wildfires, are driving the demand for more robust natural disaster insurance. Property owners in areas prone to such hazards are seeking comprehensive coverage to mitigate potential losses.

-

Cybersecurity Threats: As technology advances, so do cybersecurity risks. Property owners with home-based businesses or those managing rental properties online are investing in policies that address cyber-related liabilities.

-

Pandemic-Related Risks: The COVID-19 pandemic highlighted the need for coverage related to health crises. While not a standard feature, some policies are now offering options for coverage related to pandemics or infectious diseases.

Policy Offerings and Comparisons

When seeking the best coverage, property owners must navigate a range of policy options. Here are some important considerations:

-

Homeowners Insurance Quotes: Comparing homeowners insurance quotes is essential for finding the best home insurance rates. This process involves evaluating different policies to ensure they meet the specific needs of the property owner.

-

Home Insurance Comparison: Conducting a thorough home insurance comparison helps identify the most comprehensive and cost-effective policies. This comparison should include factors like coverage limits, exclusions, and discounts.

-

Property Insurance for Landlords: For those owning rental properties, understanding property insurance for landlords is crucial. This type of insurance typically covers property damage and liability related to tenants.

-

Insurance for Investment Properties: Investors need to consider insurance for investment properties to protect against risks associated with rental income and property management.

Insurance for Various Property Types

Different property types require tailored insurance solutions. Here’s a breakdown of some key options:

-

Condo Insurance Quotes: Condo insurance quotes provide coverage for condominium owners, addressing specific risks associated with shared structures and communal areas.

-

High-Value Home Insurance: High-value home insurance offers specialized protection for luxury homes, covering unique risks and providing higher coverage limits.

-

Insurance for Vacant Properties: Properties that are unoccupied for extended periods require insurance for vacant properties to address risks such as vandalism or maintenance issues.

-

Insurance for Mobile Homes: Insurance for mobile homes caters to the specific needs of mobile home owners, including coverage for mobile home structures and contents.

Home Insurance for Specific Needs

Addressing unique requirements is crucial for adequate protection. Consider the following:

-

Home Insurance for First-Time Buyers: Home insurance for first-time buyers helps new homeowners navigate the complexities of insurance, ensuring they understand their coverage options and requirements.

-

Home Insurance for Seniors: Seniors may have different needs, making home insurance for seniors a valuable option. These policies often consider factors like reduced risk of certain types of claims.

-

Insurance for Historic Homes: Insurance for historic homes provides coverage tailored to the unique characteristics and preservation needs of older properties.

-

Home Insurance for New Construction: Ensuring that home insurance for new construction addresses the specific risks associated with newly built homes is crucial for new homeowners.

Discounts and Cost-Saving Strategies

To manage insurance costs, property owners can explore various discounts and strategies:

-

Home Insurance Discounts: Many insurers offer home insurance discounts for features such as security systems, smoke detectors, and bundling policies. These discounts can significantly reduce premiums.

-

Cheap Homeowners Insurance: Finding cheap homeowners insurance requires careful comparison and consideration of coverage limits and deductibles to balance affordability with adequate protection.

What's Your Reaction?